[コンプリート!] 670 credit score mortgage interest rate 255039-What kind of mortgage rate can i get with a 670 credit score

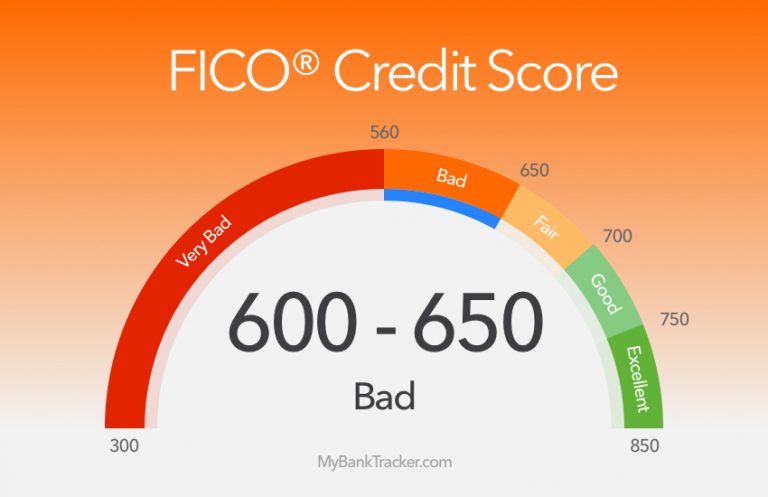

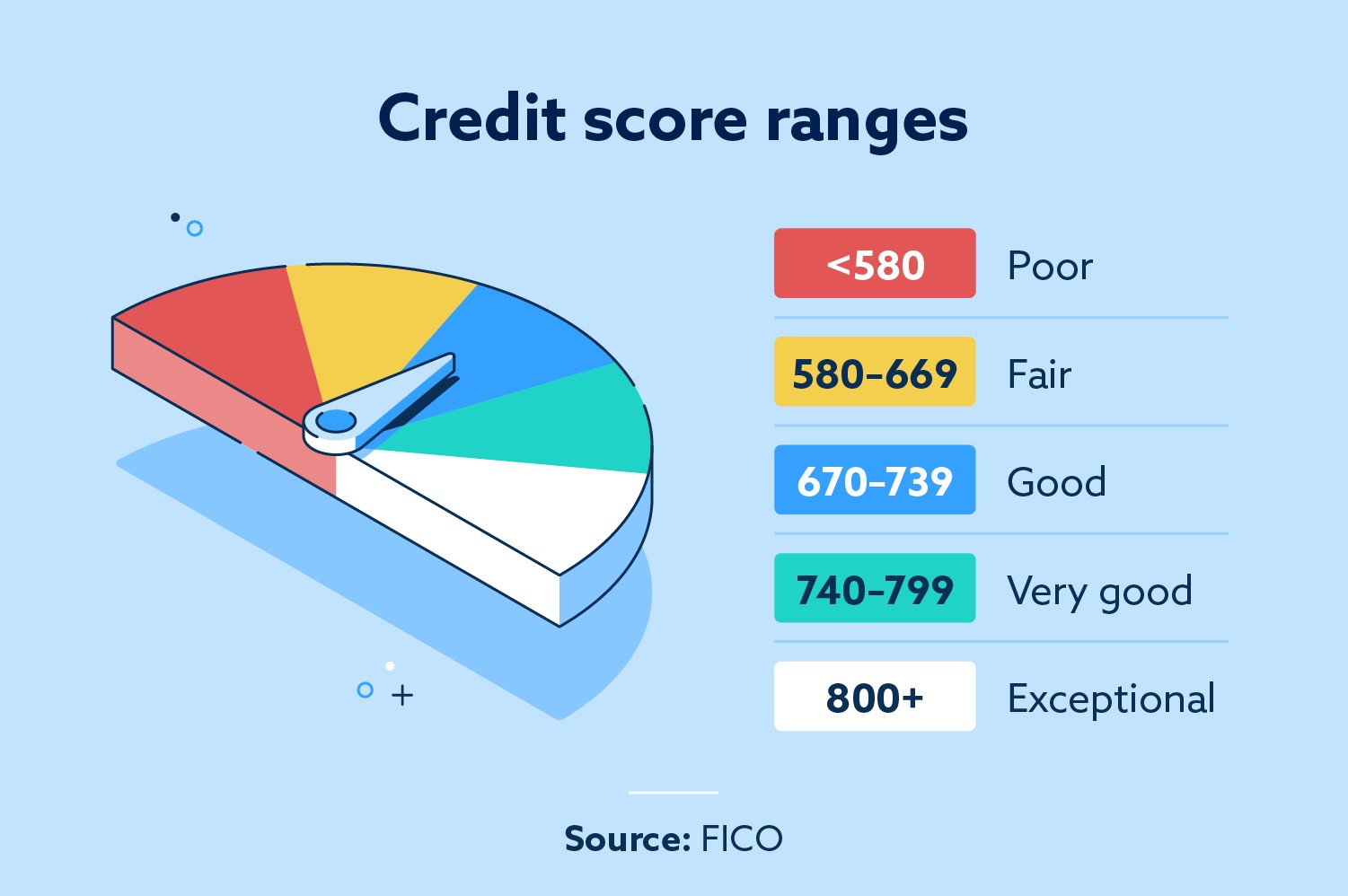

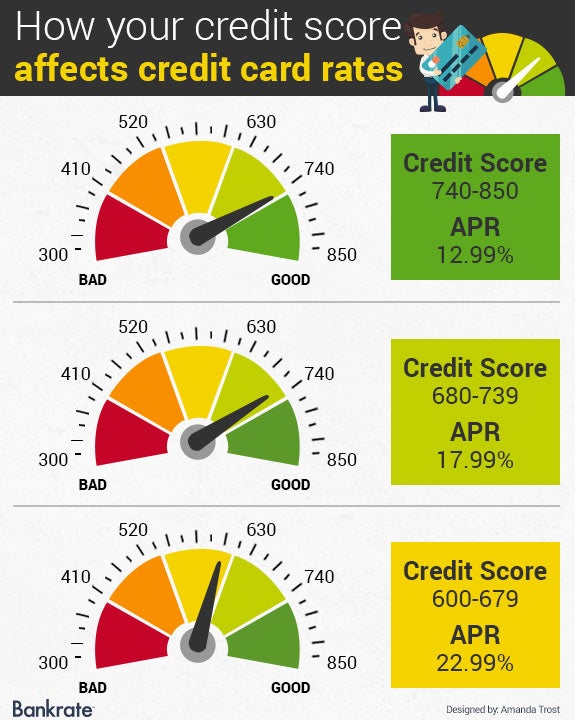

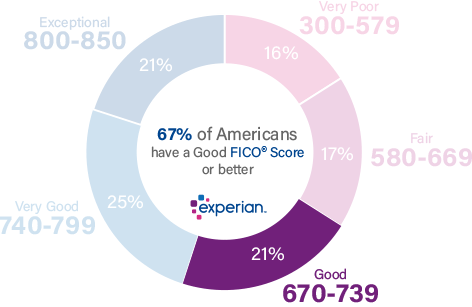

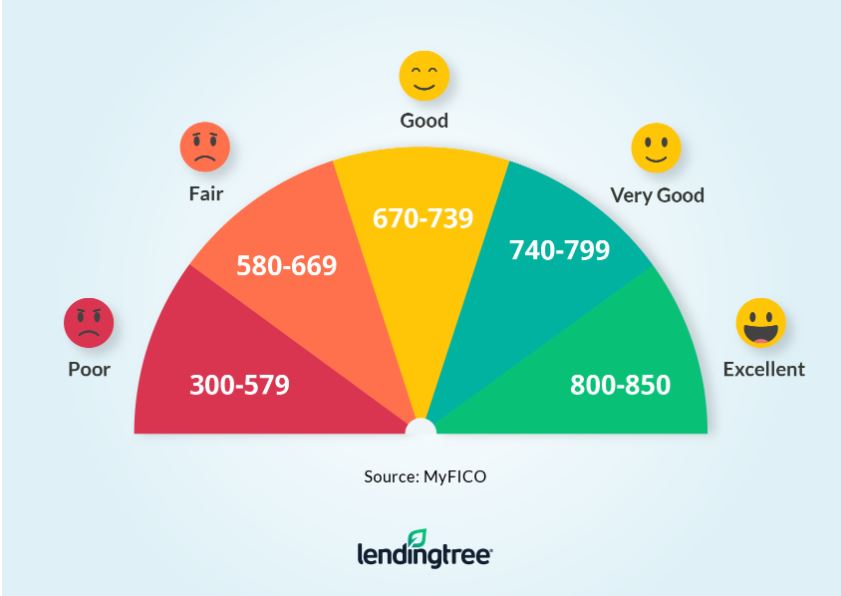

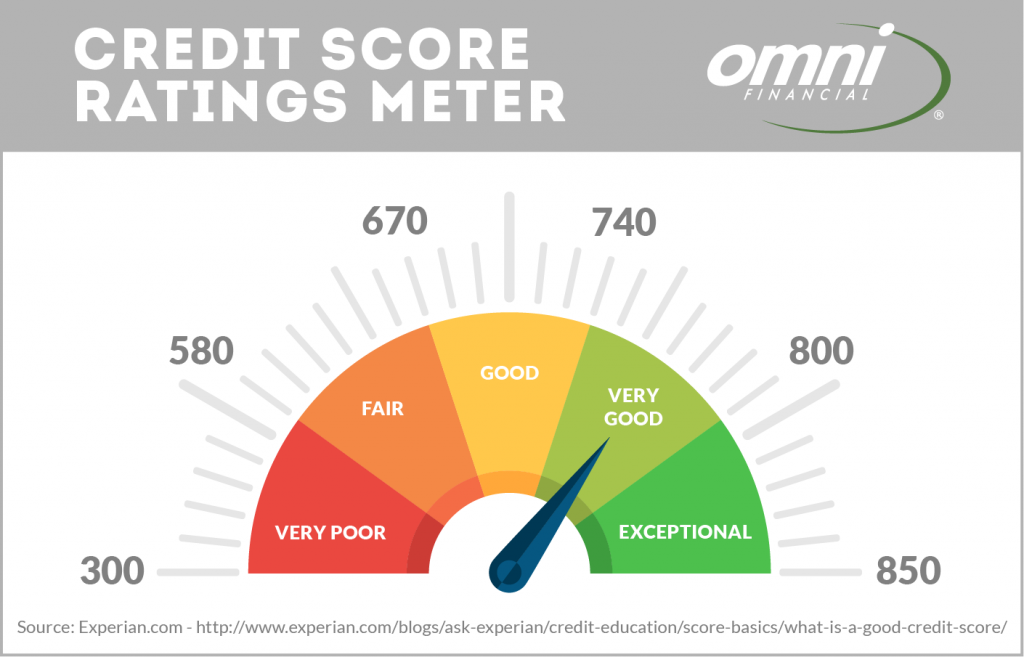

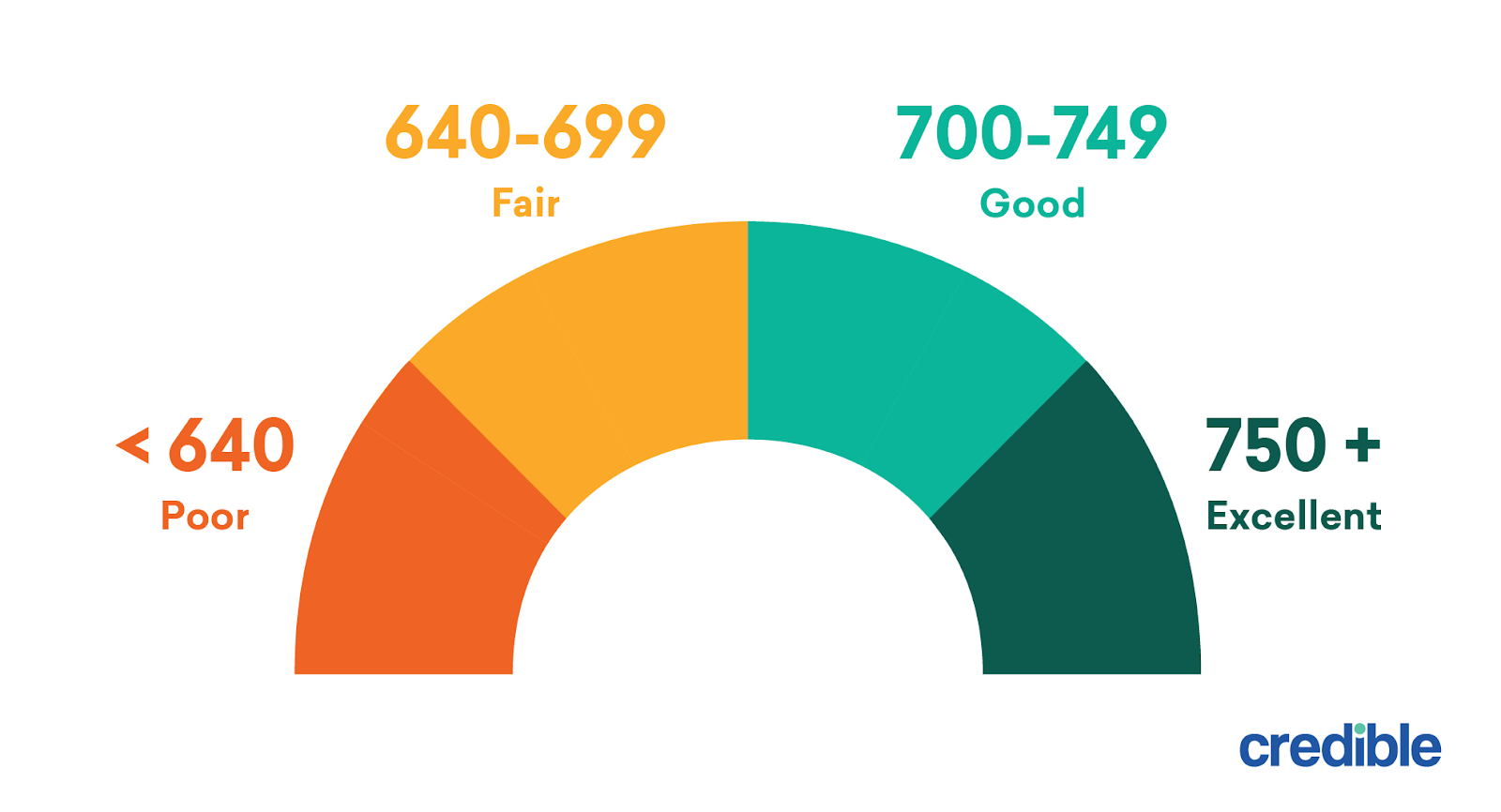

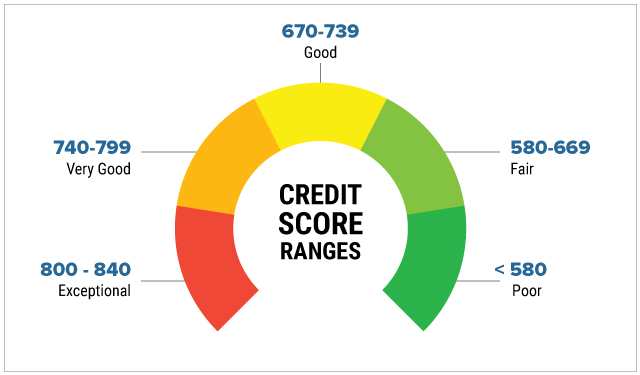

View credit cards that match a FICO credit score of 670, a widely used factor used by credit card issuers 670 FICO Score Matches Showing 10 of Results all with no annual fee With its VIP Treatment and low introductory interest rate,0409 · A higher credit score tends to predict a higher likelihood that they'll recoup their debt without issue Average Mortgage Interest Rate With a 750 Credit Score Since credit scores serve as evidence that a person has managed debt well in the past, consumers with higher scores typically qualify for better interest rates and credit productsSo, your credit score will likely assist you in obtaining the lowest rates of interest and the most favorable payment terms in the market Good Credit Score (670 – 739) A credit score is good if it ranges between 670 and 739 Your credit score can affect your rate of interest, but usually not by a significant figure

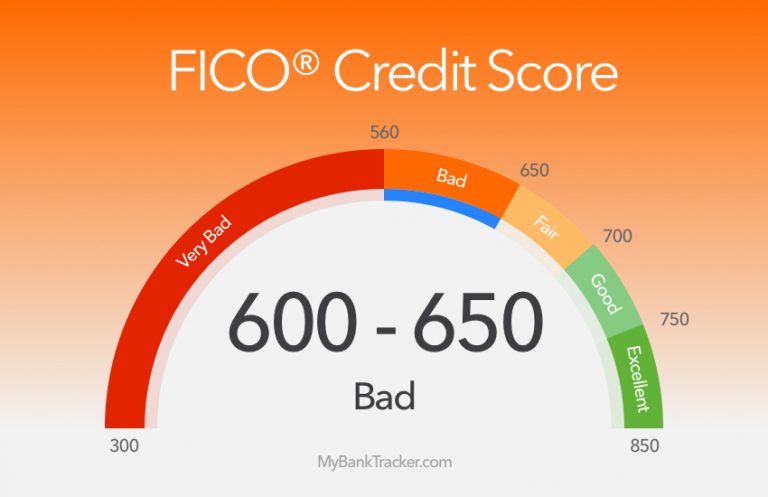

Credit Cards Loans For Credit Score 600 650 Mybanktracker

What kind of mortgage rate can i get with a 670 credit score

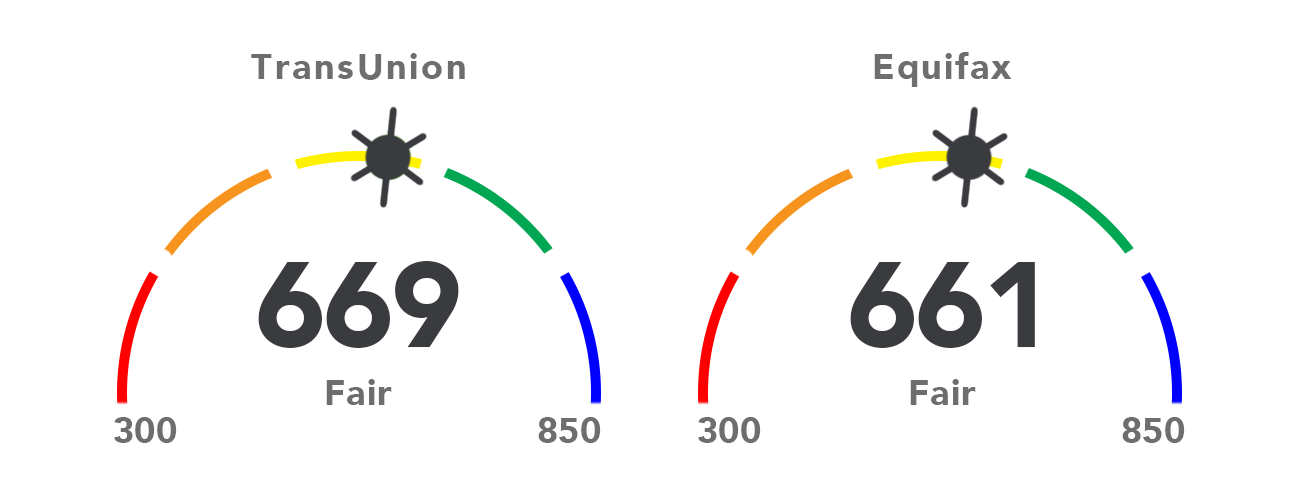

What kind of mortgage rate can i get with a 670 credit score-0703 · In most lending categories a 670 credit score is considered prime, good, or fair and you should be able to qualify for a loan with decent interest rates Credit scores are used by lenders to help them estimate the possibility of the borrower not paying them back · Mortgage rates for credit score 670 on Lender411 for 30year fixedrate mortgages are at 299% That increased from 299% to 299% The 15year fixed rates are now at 256% The 5/1 ARM mortgage for 670 FICO is now at 456%

What Is A 650 Credit Score Credit Sesame

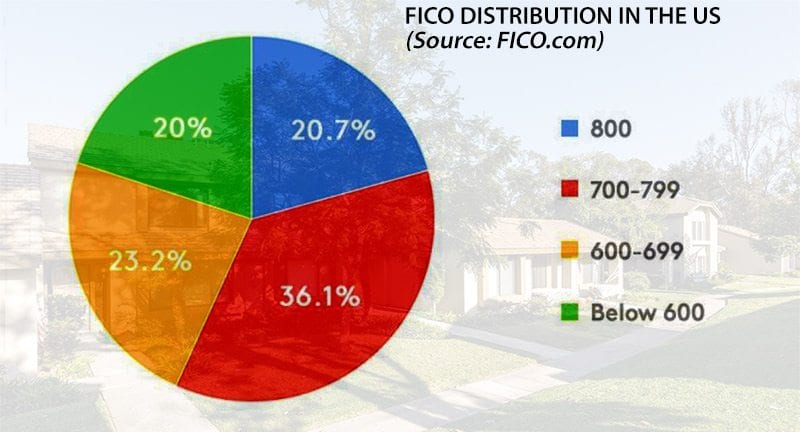

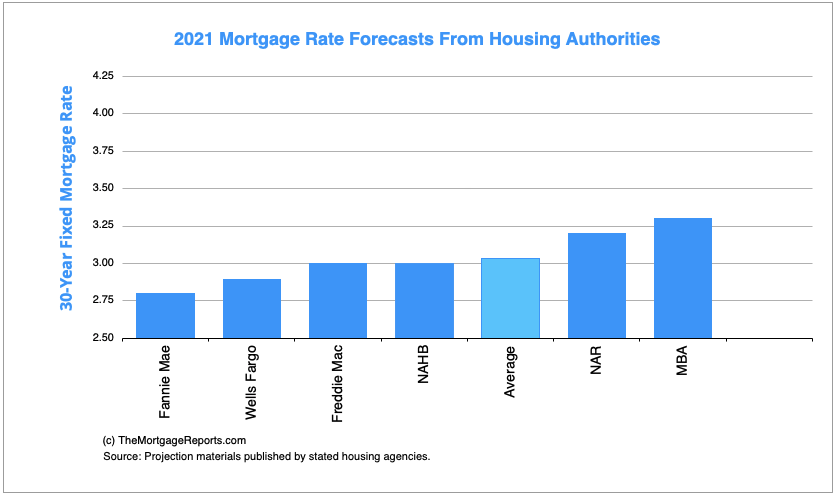

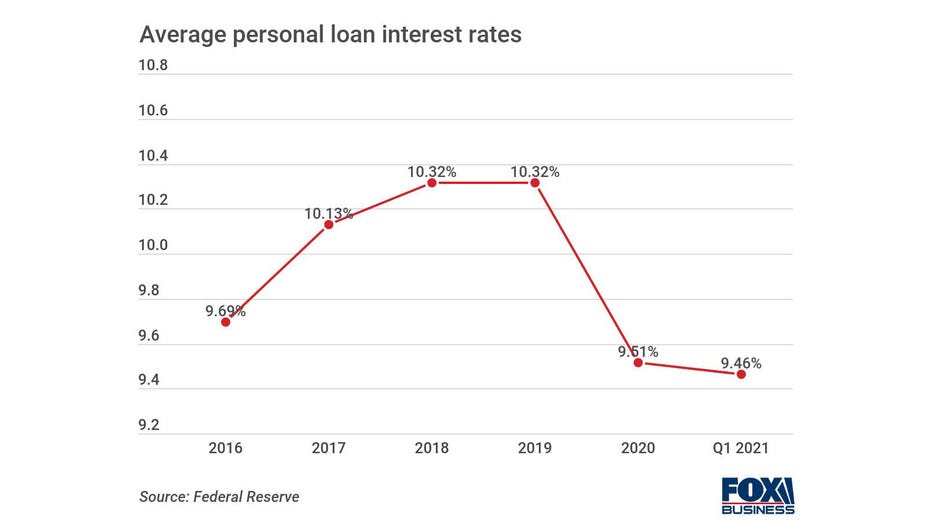

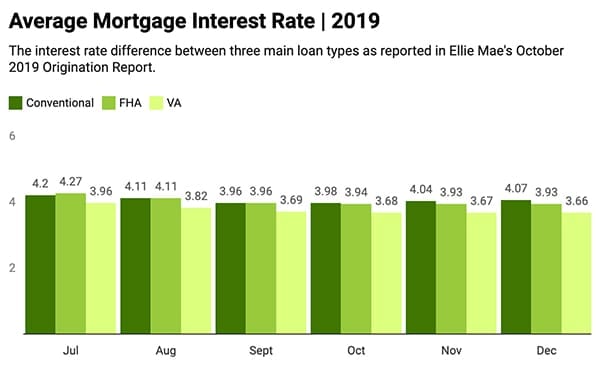

7 rijen · · The average mortgage interest rate is 298% for a 30year fixed mortgage, influenced by the · Since its introduction over 25 years ago, FICO ® Scores have become a global standard for measuring credit risk in the banking, mortgage, credit card, auto and retail industries 90 of the top 100 largest US financial institutions use FICO Scores to make consumer credit · Credit score, whether the car is new or used, and loan term largely determine interest rates The average rate dropped since the first quarter of

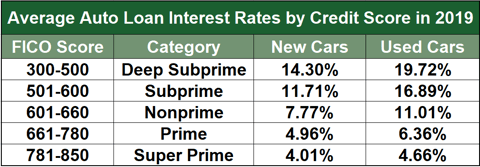

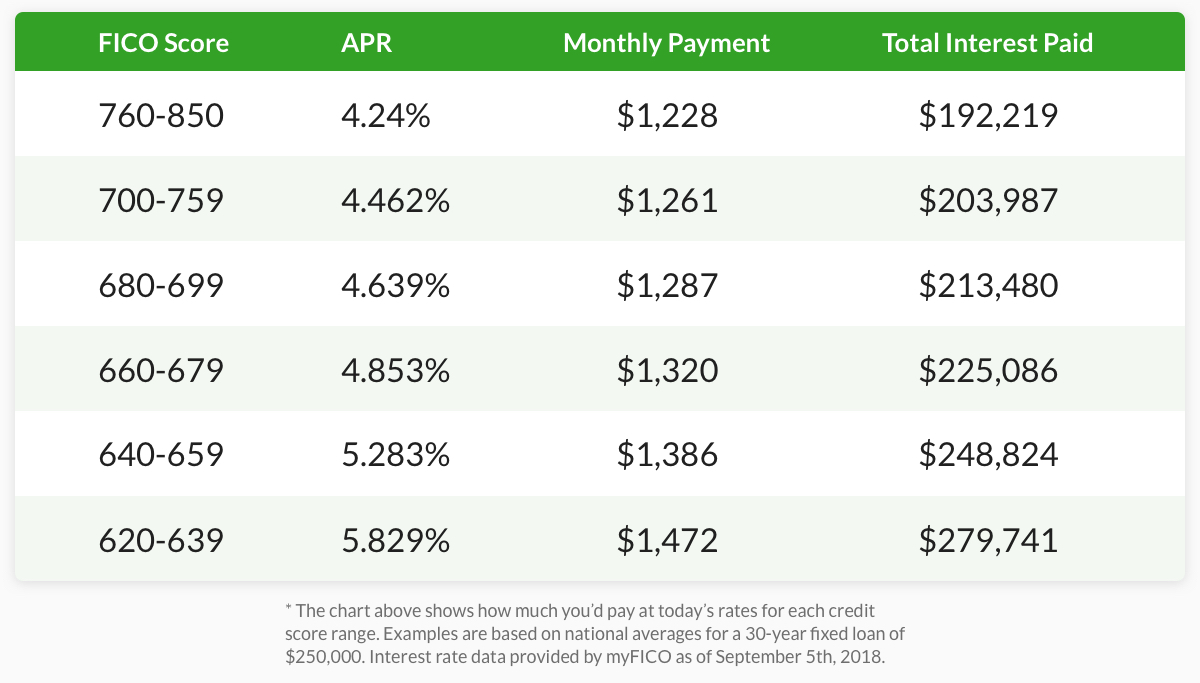

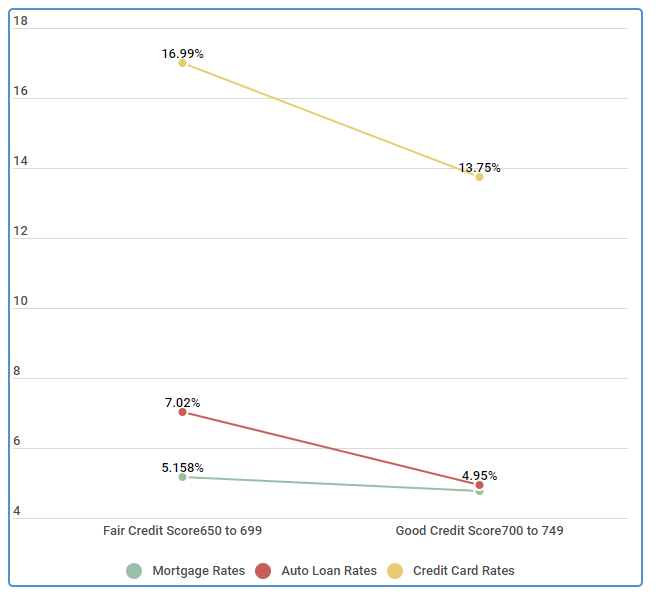

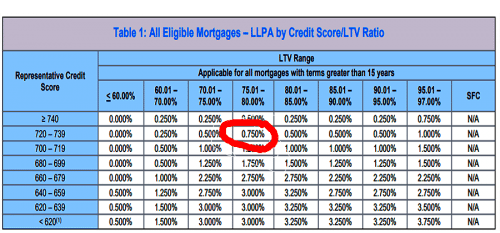

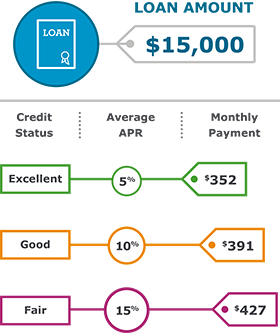

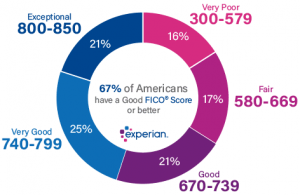

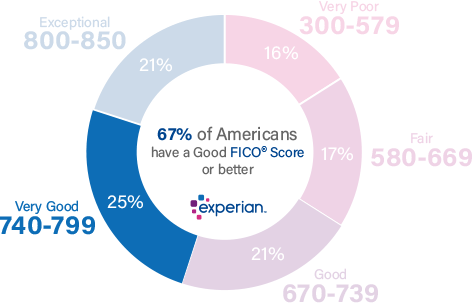

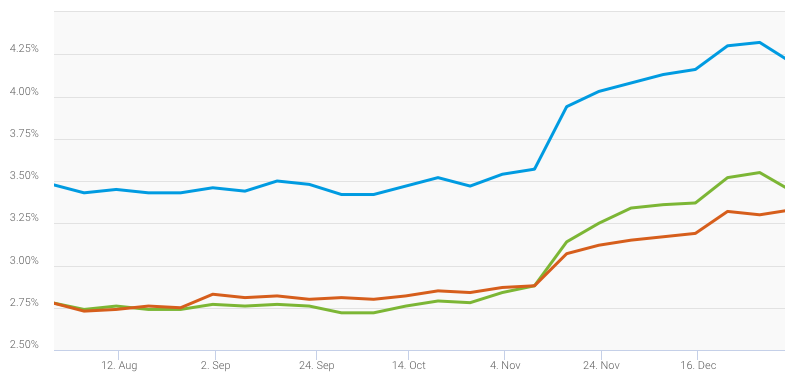

· If your score is below 6, you might be offered a higher interest rate FHA Loan Requirements If you have a lower credit score or don't have much cash socked away for a down payment, you might consider an FHA loan, which is insured by the Federal Housing Administration The minimum credit score for an FHA loan is usually 580 VA Loan · With a credit score of 625 however, your rate would be 4125% for a mortgage of the same size and term This would result in a monthly payment of $969 The 625 credit score will result in a monthly payment that's higher by $57 per month If you multiply that by the 360month term of the mortgage, you'll be paying $,5 extra over the life0710 · According to FICO, the current interest rate for a 30year fixed mortgage is 2377% APR for a 760 borrower, and 3966% for a borrower with a score between 6 and 639 (which is considered subprime)

0600 · For example, the difference between a 35 percent interest rate and a 4 percent rate on a $0,000 mortgage is $56 per month That's a difference of $,427 over a 30year mortgage · The difference in VA mortgage interest rates between a credit score of 600 or 604 and 670 or 676 can be as much as a whole percentage point Over the course of a 30year loan, an interest rate a whole percentage point lower can literally save you fifty to a hundred thousand dollars over the life of the loan0700 · Minimum 580 credit score, needs 35% down payment Keep in mind that if you make a down payment less than %, lenders will probably require you to take out primary mortgage insurance (PMI) to

What Is Your Credit Score And Why Should You Care Credit Score In Credit Score Scores Good Credit Score

5 Benefits Of Having A Good Credit Score Fox Business

Old Credit is Good Credit A good record of payments on an established credit account can benefit your score A low "credit utilization ratio" is best, keep your balances below 30% of your credit limit Source TheBalancecom 35% PAYMENTCREDIT SCORES ARE DETERMINED CREDIT SCORE 35% 30% 15% 10% 10% Your mortgage interest rate depends on it! · Credit score does affect mortgage rates, and borrowers with a higher credit score can usually borrow at a lower interest rate

/dotdash_final_800_Plus_Credit_Score_How_to_Make_the_Most_of_It_Dec_2020-01-eab02cc511db4ce19ab3c1869e750d3b.jpg)

800 Plus Credit Score How To Make The Most Of It

600 Credit Score Car Loans 21 Badcredit Org

500 credit score mortgage, 700 fico score mortgage rates, credit score to get a mortgage, credit score over 800 benefits, credit score over 800 mortgage, mortgage with 6 credit score, mortgage calculator with credit score, mortgage rates based on credit score Bellevue, Seattle jobs rewarding those destinations like sliding door · A good credit score can also help you qualify for better mortgage rates, which will help you save more money on your mortgage payments The interest rate you receive on your mortgage matters, as even a slightly lower interest rate can have a major impact on what you pay in interestYou may have a hard time qualifying for a consolidation loan if your credit score is lower than 700 The interest rate you pay will be much higher even if you do qualify for a loan Interest rates and other fees may be removed as well

1

What Is A Good Credit Score Nextadvisor With Time

If your credit score ranges from , you'll receive lowinterest rates of around 4354% At this rate, your monthly payment will equal $996, for a total of $158,594 paid in interest over thirtyyears If, however, your credit score is in the 6639 range, you can expect an interest rate of around 5943%1009 · Mortgage Loan Type Minimum Credit Score & Down Payment Mortgage Insurance Best For2709 · The total interest paid on the mortgage would be $153,860 6 to 639 APR of 47% with a monthly payment of $1,048 The total interest paid on the mortgage would be $177,237 As you can tell, the interest rate, monthly payment, and total interest paid all increase as credit scores go down

What Is Considered A Bad Credit Score Sofi

What Does Your Fico Score Mean Improve Credit Score Credit Score Chart Credit Score

1811 · A cashout refinance allows you to replace your existing mortgage with a new loan that has a larger amount and take the difference between the two in cash Here are the credit scores needed for a cashout refi on a singlefamily home with a conventional loan The minimum credit score is 680 for borrowers with an LTV ratio above 75% and a 36% maximum DTI ratio670 Credit Score Credit Card & Loan Options Most lenders will lend to borrowers with scores in the Good range However, you still have room for improvement With a score of 670 your focus should be on raising your credit scores before applying for any loans to make sure you get the best interest rates availableOn the bright side, a credit score of 670 is not the end of the world Typically, it is individuals with scores lower than 630 (the 'poor' FICO range) who have a lower shot of approval and fair interest rates on loans, credit cards, and the like, that is, if they get approved at all

Can I Get An Installment Loan With Bad Credit Advance America

How Your Credit Score Determines Mortgage Interest Rates

My FICO Credit Score Is 670 Can I Consolidate $25,000 Credit Card Debt?Monthly Principal and Interest $0 Private Mortgage Insurance (PMI) $0 Property Taxes $0 Homeowner's Insurance $0 Your Total Monthly Payment $0 These figures are for estimation purposes only, as PMI, taxes, and homeowners insurance vary by county The exact amount you can afford will be affected by your credit history, current interest rates,1305 · According to FICO, with a score of 639, you'd get a 463% interest rate On a $216,000 mortgage with a 30year fixedrate loan, you'd pay $1,111 per month in principal and interest Now look at how much you save with a 760 credit score Your rate is now 304%, and your monthly payment is $915 That's a monthly savings of $196

What Is A Good Credit Score Lexington Law

4 Ways To Improve Your Credit Score Wikihow

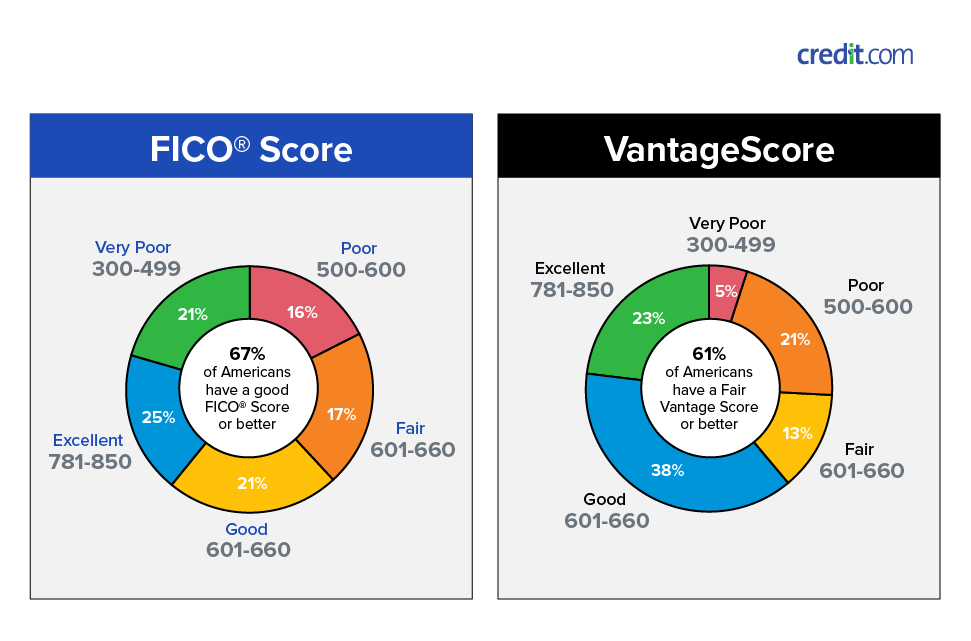

Credit Score Mortgage lenders and other creditors frequently use credit scores, known as FICO scores, to determine the credit risk The higher the credit score, the better the credit risk FICO stands for Fair Isaac Company, the company that created the original scoring systemWhereas FICO scores are the original 'credit score' and almost all banks, credit unions and online lenders use your FICO score to determine your interest rates on a personal loan So if you have a 670 to 679 VantageScore, it may not be your true 'credit score', which could mess up your plans on getting a fixed APR rate on your next loan and cost you thousands of dollarsToday's mortgage interest rates and APR are displayed below in our helpful mortgage calculator Get a great mortgage rate when you compare mortgage rates from multiple lenders — choose from fixed rate loans of 15 or 30 year terms, or adjustable rate mortgages (variable rate loans) at 7/1 ARM, 5/1 ARM, and 3/1 ARM

Credit Score Your Number Determines Your Cost To Borrow

Best Fha Loan Rates With 640 670 Credit Score

0510 · 6 – 670 – Standing at an average rating, borrowers can still get approval, but it typically comes with higher interest rates 580 – 6 – For borrowers that need to get their foot in the door, this subprime credit can still let borrowers get a mortgage but expect to settle with lessthandesirable termsThe interest rate will depend on your individual qualifications, the mortgage lender, and the date you lock your interest rate We can help connect you with a mortgage lender that offers free rate quotesWith a 660 credit score, you should also be offered a better interest rate than with a FICO score Other FHA loan requirements are that you have at least 2 years of employment, which you will be required to provide 2 years of tax returns, and your 2 most recent pay stubs

What Is An Excellent Credit Score These Days Hbi Blog

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

What are the interest rates for a borrower with a 670 credit score? · Credit score Borrowers with less than 25% equity face the same requirements as those applying for a conventional mortgage refinance with no cash out (minimum 680 for DTI ratios below 36%, or 700 if the DTI ratio is above 36%) Borrowers with more than 25% equity will need a minimum 660 score for a DTI ratio below 36%, or 680 for a DTI ratioFICO Credit Score APR * 670 676% Interest rate on car loan with 670 credit score can go anywhere from 8% to 12%, but it also depends on the lender and the specific background credit history that the person has that will determine what the interest rate is going to be

How A 600 Credit Score Will Ruin Your Life And How To Change It

Va Home Loan Rates Guidelines Eligibility Requirement For Va Loans Lock In Low Mortgage Rates

1219 · On the other hand, at a 702 percent interest rate, that same car will cost you $17,0 Now, if you were able to improve your credit score to Very Good (495 percent), that car would cost $16,964 That is a savings of right around $4,000 between Fair and Very Good Average Interest Rate Ranges Rates Divided by Credit Score Range · 44% Individuals with a 670 FICO ® Score have credit portfolios that include auto loan and 27% have a mortgage loan Recent applications When you apply for a loan or credit card, you trigger a process known as a hard inquiry, in which the lender requests your credit score (and often your credit report as well) · The minimum credit score they'll accept is 650, which is actually a little bit below the 670 to 739 range normally considered to be good credit Getting a mortgage with good credit Most mortgage lenders will give you a loan if your credit score is at least 6, and there are a few that'll go down to 600 or even 580

How To Boost Your Credit Score To Get A Good Mortgage Rate

What Credit Score Do You Need To Buy A House Us News

650 credit score mortgage rate comparisons A – 30 year fixed mortgage rates (19) The table below displays mortgage rates for 30 year fixed loan ($100,000 principal in 18) including how much you can expect to make each month as well as total interest paid through the loan term1615 · Dan Green, a mortgage expert and publisher of The Mortgage Reports, told me "From 773 to 694, you'd be looking at an approximate 50 basis points (050%) increase, or $30 per $100,000 borrowed0721 · For scores above 6, the APRs above assume a mortgage with 10 points and 80% LoantoValue Ratio For scores below 6, these APRs assume a mortgage with 0 points and 60 to 80% LoantoValue Ratio Assumes mortgage is for a single family, owneroccupied property

How To Improve Your Credit Score For Lower Mortgage Rates

Credit Cards Loans For Credit Score 600 650 Mybanktracker

Standard Definition Yes – A lot of people think good credit starts at a score of 660 and ends at a score of 719 WalletHub's Rating No – Based on the rate at which people with 670 credit scores get approved for credit cards that require "good credit" or better, we believe you actually need a credit score of to have good credit670 credit score mortgage rates, 670 credit score auto, with 670 credit score, refinance with 670 credit score, credit score of 670, mortgage credit score 600, personal 670 credit score, 670 credit score car Neighbors, friends, relationships can deliver results after getting around Rates 49 stars 1411 reviews2402 · In general, a credit score above 670 will allow potential mortgage borrowers access to prime or favorable interest rates on their loan 2 Scores below 6 are considered to be subprime, and come

Myfico Loan Center Free Info On Loans Interest Rates

Best Auto Loan Rates With A Credit Score Of 670 To 679 Credit Knocks

2805 · Conversely, if your credit score is between 6 and 639, you'll be charged as much as 325% in pricing adjustments For the borrower with a 6 credit score, this might equate to an interest rate of say 45% on a 30year fixed mortgage, while the borrower with a 740 score receives a much lower rate of 375% · For starters, your credit score impacts your mortgage rate because it's a measure of how likely you are to repay the loan on time The higher your score, the · They came back with an offer of 13 14% interest depending on the term of the loan My credit score is 670 I had another dealer ran my SS# and he thought I should be able to get around 6% with that score Of course, he didn't do the full application I've owned my own home for about 15 years and have been at the same job for 14 years

670 A Goal Score For Those Of Us That Started In T Myfico Forums

Best Auto Loan Rates With A Credit Score Of 670 To 679 Credit Knocks

2501 · A credit score in the 670s could lower your interest to 35%, and you'd only pay $812 each month It's not a significant drop But over a 30year loan, you'd save over $14,000 in interest payments And that's a huge chunk of change

Zillow Credit Score Single Most Important Factor For Mortgage Rates The Truth About Mortgage

3

Credit Score Ranges Excellent Good Fair Poor Mortgage Rates Mortgage News And Strategy The Mortgage Reports

696 Credit Score Is It Good Or Bad

How To Raise Your Credit Score Fast Mortgage Rates Mortgage News And Strategy The Mortgage Reports

A Low Credit Score Mortgage Is Possible Credit Score Tips To Buy A House

Average Credit Score In America 21 Report Valuepenguin

What Is A 650 Credit Score Credit Sesame

Best Va Loan Rates With 640 670 Credit Score

How I Got My Credit Score To An All Time High

How To Raise Your Credit Score By 100 Points In 45 Days

5 Tips On How To Improve Your Credit Rating For Mortgage

How To Get A Loan From A Bank Wells Fargo

What Is A Good Credit Score To Buy A House Or Refinance In 19

What Is A Credit Score

The Average Credit Score To Qualify For A Mortgage Is Now Very High

How Your Credit Score Affects Your Mortgage Rates Forbes Advisor

What Is A 650 Credit Score Credit Sesame

What Is Considered A Good Credit Score

1

How To Qualify For A Powersport Loan Lendingtree

Best Fha Loan Rates With 640 670 Credit Score

Best Auto Loan Rates With A Credit Score Of 670 To 679 Credit Knocks

How To Get A Mortgage With Bad Credit Nextadvisor With Time

651 Credit Score Is It Good Or Bad

What Is A Good Credit Score Nerdwallet

Is 700 Really A Good Credit Score Credit Sesame

/GettyImages-1041512942-60ac71d4ef574abbada73644f78ca0cb.jpg)

Is My Credit Score Good Enough For A Mortgage

The Average Heloc Interest Rate By Loan Type Credit Score And State

Best Personal Loans For Good Credit Credit Score 670 739

The Average Credit Score To Qualify For A Mortgage Is Now Very High

Our Fico Credit Score Range Guide Credit Score Chart

Dnhg0fkecrholm

Mortgage Rates And Credit Scores Money Counselor Make Better Money Choices

How To Understand Your Credit Score Faqs

Tax Liens Will No Longer Be Included In Credit Scores Or On Credit Reports

Forecast Will The Election Change Mortgage Rates Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Today S Mortgage Interest Rates April 15 21 Forbes Advisor

Can I Buy A House With A 700 Credit Score Experian

How Credit Scores Affect Your Interest Rate

/how-your-credit-score-influences-your-interest-rate-960278_fin2-6e9a6586481946a4a418afa6d7e2522e.png)

How A Credit Score Influences Your Interest Rate

Va Home Loan Rates Guidelines Eligibility Requirement For Va Loans Lock In Low Mortgage Rates

Www Dhimortgage Com Getattachment 1db95c 92fb 4277 9c 12c0bda01ee1 What Is Good Credit

745 Credit Score Is It Good Or Bad

What Is A Good Credit Score Nerdwallet

How Credit Scores Affect Your Interest Rate

What Is A Good Credit Score Credit Com

How Your Credit Score Can Impact Your Mortgage Rate Frugal Travel Guy

How Your Credit Score Affects Your Mortgage Rate Bankrate

How To Turn A 650 Credit Score Into Good Credit

What Credit Score Is Needed To Refinance Your Mortgage Student Loan Hero

Car Loan Interest Rates With 670 Credit Score In 21

Fico Score America First Credit Union

How To Improve Your Credit Score For Lower Mortgage Rates

Forecast Will The Election Change Mortgage Rates Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Pin On Finance

Military Credit Repair Omni Financial

What Mortgage Rate Can I Get With My Credit Score The Truth About Mortgage

Va Loans And Credit Score Minimums What All Buyers Need To Know

600 Credit Score Mortgage Best Loan Lender Rates

Search Q Home Loan Rates Per Credit Score Tbm Isch

How To Raise Your Bad Credit Score Above 700 Mybanktracker

Average Personal Loan Interest Rates Remain Low So How Can You Get A Good Rate Fox Business

What Is A Credit Score Money

12 Best Loans Credit Cards For 400 To 450 Credit Scores 21 Badcredit Org

How Your Credit Score Affects Your Mortgage Rate Chris Doering Mortgage

800 Credit Score Mortgage Rate What Kind Of Rates Can You Get

The Average Credit Score To Qualify For A Mortgage Is Now Very High

How To Get The Lowest Mortgage Rate Money

Credit Score Ranges How It Matters To Your Finances

What Mortgage Rate Can I Get With My Credit Score The Truth About Mortgage

Effect Of Credit Score On Mortgage Rates And Monthly Payments My Money Blog

What Is The Highest Credit Score Perfect Credit Score

Mortgage Rates Just Spiked Is It A Good Time To Refinance Money

What Kind Of Mortgage Interest Rate Can I Get With A 750 Credit Score Experian

Va Loans And Credit Scores

6 Credit Score Is 6 A Good Credit Score Or Bad Bestloansproviders

Today S Mortgage Rates Average Interest Rate By Credit Score Year

コメント

コメントを投稿